Why Many Students Are Switching to Digital Payment Tools

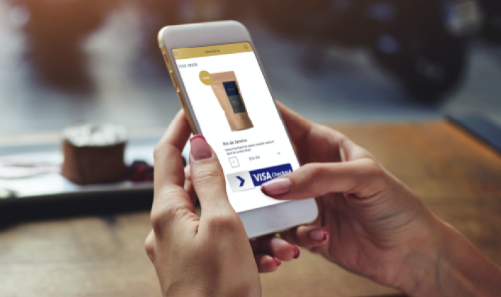

A few months ago, I watched a friend panic at a café because she realized she had forgotten her wallet. Classic student moment. The kind where your stomach drops and you start patting every pocket like a cartoon character. Then she shrugged, tapped her phone, paid, and returned to her iced coffee like nothing happened.

That was when it hit me: students aren’t just “using” digital payments anymore. They’re living through them. It’s part of their rhythm now. Part of their routine. Part of how they manage school, work, and all the small daily chaos in between. By the way, in some student communities — especially in Brazil — tools like Rateio de curso (Brazil for “splitting the cost of a course,” i.e., students pooling money to access a class or study materials) naturally pop up in conversations, usually when groups organize shared study materials or split learning costs in smarter ways.

And the more you look at it, the more obvious it becomes: digital payments aren’t a trend. They’re a quiet revolution.

The Shift: Why Students Are Letting Go of Traditional Ways

Growing up, we were taught that money lived inside a card or a bank branch. Now it lives inside an app. Or more accurately, inside dozens of apps. And it works.

Students move fast. Their days rarely go as planned. One minute they’re studying, next minute they’re running to class, then suddenly they’re splitting a bill with five friends who all swear they “sent it already.”

Digital payments solved this. Not perfectly, but enough.

It’s not just about convenience. It’s about flexibility and control. You can check your balance while waiting for the bus. Pay a bill at midnight. Send a friend money without scrambling for an ATM.

The financial world finally adapted to student life — not the other way around.

What Makes Digital Payments So Appealing?

1. Speed (The First Love of Every Student)

Time is always tight. Digital payments cut out the slow parts: long queues, searching for a card, dealing with cashiers who say “the machine is offline.”

A quick tap, scan, or click and you’re done.

2. Transparency — With No Awkward Conversations

You know the moment when friends are splitting food costs and suddenly everyone forgets who ordered what?

Digital apps solve this with logs, screenshots, and payment histories. No debates. No drama. Just clarity.

3. Budgeting Tools That Actually Make Sense

Most students aren’t taught money management in school. The apps fill the gap. Spending alerts, trends, categories, and reminders help students avoid late fees and unnecessary stress.

It’s like having a tiny financial coach in your pocket.

4. Security That Feels More Modern

Ironically, paying digitally often feels safer than carrying cash or cards. Biometrics, passwords, instant notifications — they make you feel in control.

Losing your phone is stressful, yes, but losing your wallet is worse.

The Social Side of Digital Payments

No one talks about this enough. Digital payments didn’t just change how we pay — they changed how we interact.

Splitting rent with roommates became smoother. Group study sessions with shared materials became easier to organize. Lending money stopped being a weird emotional negotiation.

You click. You send. You move on.

There’s something quietly freeing about that.

Where Collaborative Payments Come In

Now here’s where things get interesting. Students don’t just use digital tools for bills and coffee. They use them for learning.

Study groups. Online courses. Educational materials. Practice tests. Premium access to prep platforms.

In Brazilian communities especially, the concept of Rateio de curso shows up when students team up to make education more affordable. Instead of one person carrying the whole cost, groups split learning expenses in a structured way.

It isn’t about shortcuts. It’s about accessing opportunities that might otherwise feel out of reach.

Education is expensive. Collaboration makes it manageable.

The Emotional Reason Behind the Digital Payment Boom

Digital money feels lighter. Less stressful. Less serious, in a good way.

You don’t get that sinking feeling of handing over the last physical bill in your wallet. You don’t feel disconnected from your spending either — in fact, the apps remind you constantly.

Students often say digital payments feel like a safety net. A flexible one. You always have something with you, even when you forget everything else.

And there’s comfort in knowing that even if life throws you a curveball, you can handle it from your phone.

The Hidden Skill Students Are Building

Digital payments aren’t just a tool. They train something important: financial awareness.

You learn:

- how to track expenses

- how to plan upcoming costs

- how to avoid unnecessary fees

- how to manage shared spending

These are real-life skills. The kind that make you feel a bit more adult, even when you don’t feel like one yet.

The Future: Where Student Payments Are Heading

It’s impossible to predict every trend, but a few are crystal clear:

More Collaboration

Students will keep organizing shared learning costs, shared living expenses, shared subscriptions. It’s practical.

More Automation

Apps will automatically categorize, schedule, and optimize spending without you having to think about it.

More Integration

Payments will merge with learning platforms, public transport, campus systems, ID cards — creating one smooth ecosystem.

More Financial Independence

Digital payments subtly push students to manage their own money earlier. That’s a good thing.

Bringing Everything Together

Students are adopting digital payment tools because their lives demand speed, flexibility, and smarter financial habits. It isn’t about trends or showing off the newest app. It’s about making everyday life less exhausting.

And toward the end of the journey — whether it’s splitting lunch or organizing Rateio de curso for study plans — digital payments create a sense of teamwork and capability that traditional banking never offered. To be clear, I mention Rateio de curso descriptively, not as a recommendation; it’s simply a common label for that group cost‑sharing practice.

These tools simplify the complicated parts of being a student. They create more space for learning, social life, and actual growth.

In a world that constantly accelerates, having systems that help you stay afloat is more than convenience. It’s survival.

FAQ

1. Are digital payments safe for students? Yes. With passwords, biometrics, and instant alerts, they are often safer than carrying physical cards.

2. Do digital payments help with budgeting? Absolutely. Apps track expenses automatically and help students understand patterns.

3. Is cash still necessary? Sometimes, but less than before. Most students rely primarily on digital methods.

4. Why are collaborative payments so popular? They reduce individual costs and make education more accessible.

If there’s one takeaway, it’s this: digital payments give students freedom. Freedom to manage money on their own terms. Freedom to collaborate without stress. Freedom to focus on what truly matters — education, experiences, and becoming someone they’re proud of.